puerto rico tax incentive program

To get a sense of the tax revenue losses in the case of Second another reasonable measure of the effective- Puerto Rico we begin with the 1999 tax payments of ness of these tax incentive programs is the resulting 431 million made by 10 out of the existing 45 CFCs to inflow and composition of investment. In Puerto Rico are perhaps the most impressive of all Puerto Rican tax incentives.

Puerto Rico Maps Facts Puerto Rico Puerto Rico Map Puerto

Castellanos is personally supervising all legal and consulting work done by Castellanos Group PSC related to Puerto Rico Tax Incentives including.

. 90 exemption from municipal and state taxes on property. Aggressive Tax Incentives for Attracting Business. 100 tax exemption from Puerto Rico income taxes on all dividends.

4 or 8 fixed income tax rate. 22-2016 provides up to 11 energy credit if the tourism activity is endorsed by the PRTC and complies with the requirement stated in this form. Incentives for export activities or to attract investment to develop the Puerto Rico economy in a way that is profitable for Puerto Ricos Government tourism manufacture for exportation exportation services and international investment.

Act 22 Individual Investors Act. Fixed 1 corporate income tax rate on products manufactured in Puerto Rico by using novel pioneer technologies. Act 73 of May 28.

Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. The Tax Cuts and Jobs Act introduced major changes to the international tax provisions of the United States Internal Revenue Code of 1986 as amended which generally govern the tax consequences to US persons with operations through foreign corporations. The tax incentive program which was first created as the 2012 Act 20 and Act 22 programs could not.

Heres the guidance being put out by most of the major firms in Puerto Rico on the tax incentive programs. Puerto Rico offers a highly attractive incentives package that includes a fixed corporate income tax rate one of the lowest in comparison with any US. Now known as Chapter 3 of the Incentives Code Puerto Ricos Act 20 was originally known as the Export Services Act.

Jurisdiction various tax exemptions and special deductions training expenses reimbursement and special tax treatment for pioneer activities. This is the time to invest in puerto rico. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Incentives Code.

The tax incentive offer is mainly a four 4 income tax rate for new banking and financial businesses established in Puerto Rico under qualifying circumstances. Then under a law referred to as Act 60 formerly Act 20 and Act 22 Puerto Rico has enacted several tax incentives the two most popular of which are as follows. Act 20 Export Services Act.

The purpose of this Act is to provide incentives to individuals who have not been residents of Puerto Rico to become residents. Puerto Ricos Act 185 Tax Incentive Program The purpose of the Act 185 tax incentive is to establish the Private Equity Fund Act to promote the development of private capital in Puerto Rico. Thousands of Americans have already moved to the US-owned Caribbean island under the program to take advantage of Act 60s tax benefits with Puerto Ricos stunning beaches and vibrant culture serving as two added incentives in favor of the move.

The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities. The Department of Economic Development and Commerce DDEC implemented the Incentive for Creative Industries whose assigned amount amounts to 3 million for entities and individuals who work on their own in said sector in order to provide an economic reinforcement. 2 or 12 withholding tax on royalty payments.

Pioneer industries are subject to an income tax rate of 1 or 0 in cases where the intangible. This incentive is focused on providing assistance and reaching those who are not eligible under the. Feature films short films documentaries television programs series in episodes mini-series music videos national and international commercials video games and post-production projects.

The following is a list of the incentives available for industries who invest in RD activities in Puerto Rico. Those two tax acts offer low to no taxes on certain types of income. Taking into consideration that approximately ninety five percent 95 of Puerto Rico has been designated as an opportunity zone the Incentives Code provides tax incentives for eligible businesses that meet the following requirements.

4 corporate tax rate for Puerto Rico services companies. More recently these two acts were updated and combined in a new law called Act 60. The legislation allows Puerto Rico to offer qualifying businesses that export services from the island nation the opportunity to cut their corporate tax rate to a mere 4.

This is done through the formation of investment capital funds aimed at investing in companies that do not have access to public markets and establish the applicable. In order to encourage the transfer of such individuals to Puerto Rico the Act exempts from. Make Puerto Rico Your New Home.

100 exemption from municipal license taxes and other municipal taxes. Fixed 4 corporate income tax rate for industries who perform RD as part of their industrial activities. The fiscal impact of approximately 590M in credits and monetary stimulus excluding tax exemptions and prime taxes.

A Puerto Rican corporation thats engaged in certain types of service businesses only pays Puerto Rican tax of 4. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors. 100 tax exemption from Puerto Rico income taxes on all short-term and long-term.

Act 22 as amended also known as The Individual Investors Act was approved by the Legislative Assembly of Puerto Rico during 2012. The tax incentives enjoyed by Individual Resident Investors. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage.

The Incentives Code consolidates incentives granted for diverse purposes throughout decades like manufacturing activities and exportation of services with the aim of promoting. In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business. 100 tax exemption from Puerto Rico income taxes on all interest.

Puerto Rico Incentives Code Act 60 of 2019 The Export Services Act PR Act 60 Chapter 3 formerly Act 20 The Individual Investors Act PR Act 60 Chapter 2 formerly. Ii is not eligible for a tax decree under Act 20-2012 Act 73-2008 Act 74-2010 or Act 27-2011. 0 capital gain tax for Puerto Rico residents.

Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Part of Puerto Ricos government tax incentive programs require buying a home within the first two years of a move and you have to pay for. I render all of its activities in an eligible zone.

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

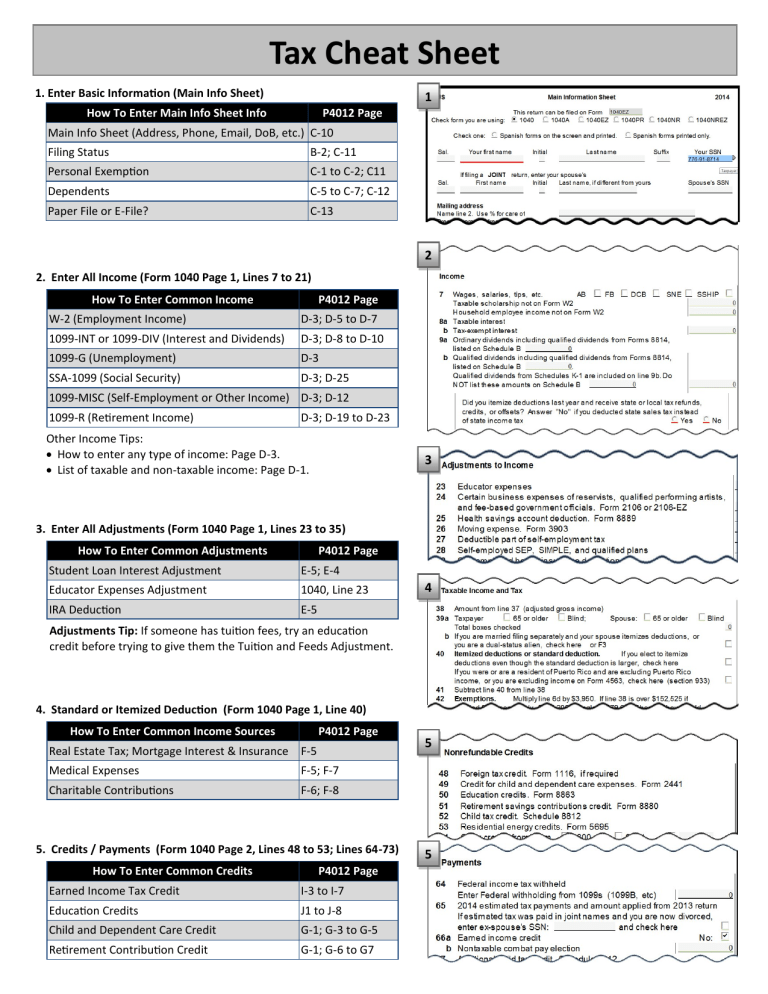

Tax Cheat Sheet Free Tax Campaign

Puerto Rico Settlement Patterns Britannica

Faqs Tax Incentives And Moving To Puerto Rico

Puerto Rico Income Tax Return Prepare Mail Tax Forms

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Top Banks In Puerto Rico Learn About The Main Banks In Puerto Rico

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Us Tax Filing And Advantages For Americans Living In Puerto Rico