new hampshire sales tax on vehicles

Start filing your tax return now. New Hampshire is one of only five states that.

What S The Cheapest State To Buy A Car

Only a few narrow classes of goods and services are taxed eg.

. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on. These costs include the registration fee title fee license plate transfer and documentation fee charged by most dealerships. TAX DAY IS APRIL 17th - There are 189 days left.

For example if you purchased a motor vehicle in New Hampshire on January 1st and brought it into Massachusetts on June 30th a use tax would be due by July 20th. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. New Hampshire is a state located in the New England region of the United States.

New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle. A 9 tax is also assessed on motor vehicle rentals. 18 per thousand for the current model year 15 per thousand for the prior model year.

New Hampshire Vehicle Sales Tax. When You Buy A Car From New Hampshire Is There Sales Tax Sapling Experts Weigh In On The Best States To Buy Any Type Of Car New Hampshire Vehicle Sales Tax Fees. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals.

Answer 1 of 3. Motor Vehicle Hearings have resumed in-person hearings or you may. As long as you are a resident of New Hampshire you wont need to.

The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax. The registration fee decreases for each year. The state meals and rooms tax is dropping from 9 to 85.

Does New Hampshire have sales tax on cars. New Hampshire does not have sales tax on vehicle purchases. Exemptions to the New Hampshire sales tax will vary by state.

Are there states with little to no sales tax on new cars. Its a change that was proposed by Gov. No there is no sales tax.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. What is the food tax in New Hampshire. There is no NH car sales tax.

New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. Prepared meals hotel rooms. What states have the.

New Hampshire DMV Registration Fees. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Heres how the additional costs associated.

The state is bordered by Massachusetts to the south. The reason you dont have to pay sales tax when you buy a car in New Hampshire is pretty simple. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

A 7 tax on phone services. Although walk-in services are available customers with an appointment will be given priority.

No Sales Tax At Nhproequip Nhproequip Com

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Pennsylvania Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States That Do Not Tax Earned Income

Does A Trade In Reduce Sales Tax Nerdwallet

How Do State And Local Sales Taxes Work Tax Policy Center

Car Leasing And Taxes Points To Ponder Credit Karma

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Is Buying A Car Tax Deductible In 2022

Free New Hampshire Bill Of Sale Form Pdf Word Legaltemplates

What S The Car Sales Tax In Each State Find The Best Car Price

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

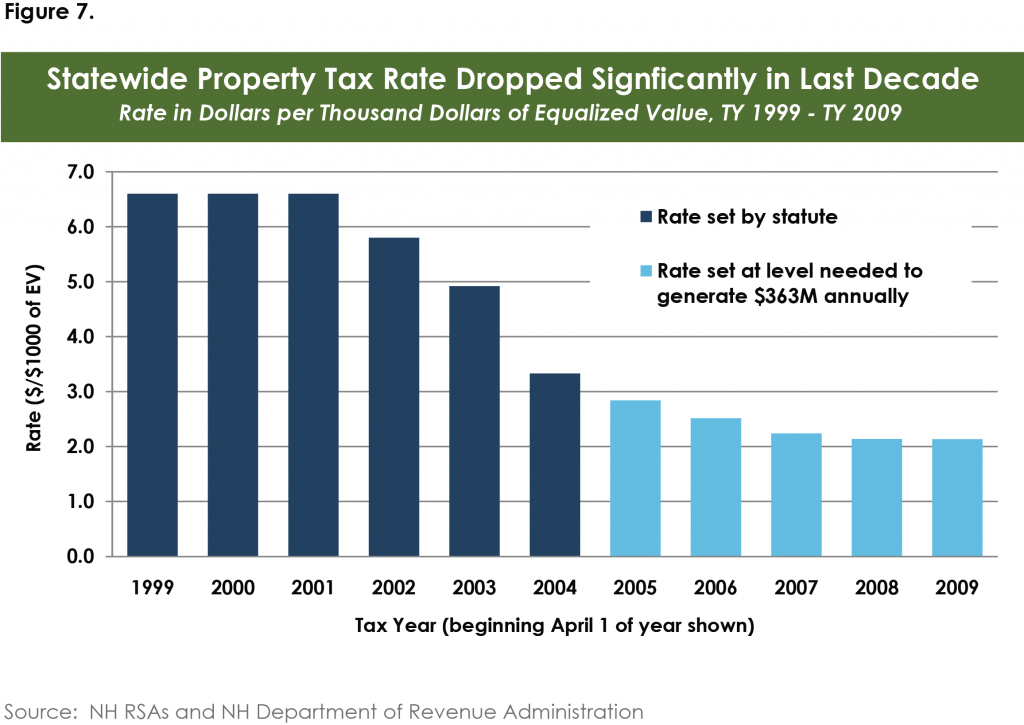

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute